The Round Rock ISD is banking on the fact that statewide tax relief and recent changes to how "Robin Hood" is handled will mask a local tax hike on the ballot Tuesday:

This is according to Don Zimmerman, longtime tax reform advocate, former Austin Council member, and executive director of the Travis County Taxpayers Union (TCTU). The ballot language, he said, is so problematic the organization is preparing to file a lawsuit -- only to find that state courts no longer hear ballot language complaints prior to an election!

Undaunted, Zimmerman charged in a post to the TCTU Facebook page the district is using obfuscatory language to convince voters the proposal equals a tax increase of zero dollars (which begs the quesiton, why is it even on the ballot? Read on).

"RRISD Prop A is a tax increase election required by state law because it's a 3 cent tax increase compared to last year; it increases last year's 5 cent 'enrichment tax' to 8 cents," Zimmerman said, of the basic fact of the matter.

Round Rock ISD's current tax rate (2022-23) is $1.0626 per $100 property valuation. The proposed rate which voters will decide Tuesday is $0.9190 per $100 valuation. The ballot language claims “an increase of 0 percent” and “additional $0.”

According to the Texas Comptroller, a new law established a process by which voters must approve any tax rate that exceeds a certain limit. The voter-approval tax rate (or VATR) is the sum of "no-new-revenue" M&O (standing for maintenance and operation -- things like salaries, utilities and day-to-day operations) and debt service rates (interest and principal on bonds and other debt secured by property tax revenues). In short: If the VATR calculation exceeds an amout that generates new revenue for the school district, it goes to the voters.

In many cases, the Comptroller's website stated, a VATR exceeds the no-new-revenue tax rate and must go before voters. Such was the case with Round Rock ISD, and locally Pflugerville ISD and Lago Vista ISD this year. These VATREs (Voter-Approval Tax Ratification Elections) are on the ballot Tuesday from 7 a.m. to 7 p.m.

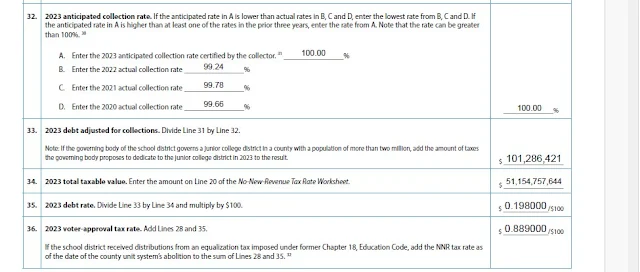

Zimmerman pointed out a 2023 Tax Rate Calculation Worksheet provided by the Round Rock ISD (see Figure A below) which "reveals how much tax RRISD can levy without forcing a VATRE."

That rate is 0.889 (line 36), which is the VATR.

The "enrichment tax rate" (line 27), Zimmermann pointed out, "is where you discover RRISD is currently enriching themselves with 5 'golden pennies,' and the District wants to increase the 5 to the maximum of 8."

Here's where things get a little more murky: "golden pennies" are revenue not subject to Robin Hood "equity" recapture -- basically, money that gets taken from one property rich district and given to other, supposedly poorer, districts. (The first eight cents a district levies above a dollar are not subject to Robin Hood recapture — thus they are called “golden pennies.” Learn more here.)

"RRISD admits to these facts in a very confusing and misleading manner in their Prop A information page [see Figure B, below] -- we expect the District to use these confusing, misleading Prop A statements buried at the bottom of their info page in court to defend themselves against deliberately deceiving voters by claiming the 3 cent 'golden penny' tax increase is a tax decrease."

The legal problem for Round Rock ISD, according to Zimmernan, is that it did not comply with the state education code (Texas Education Code 28.06b), which he contends requires Round Rock ISD to note on the ballot it represents a 3-cent increase. Such a tax increase raises the revenue by $19 million compared to last year.

"Instead, RRISD deliberately deceived voters by claiming the 2023 Legislature's increased public education spending (about $68 million to RRISD alone) -- which temporarily reduced government school property taxes -- means the 3 cent tax increase isn't a tax increase because Texas State spending temporarily lowered the tax rate," Zimmerman said.

In other words, Round Rock ISD is factoring in temporary tax cuts voted-in by the Texas Legislature this year into the equation, which makes it seem like it's not raising taxes.

For some balance, here's Round Rock ISD's presentation of the situation:

No comments:

Post a Comment

We strongly support the First Amendment. But we ask that you keep it friendly and PG.